The Government has confirmed $7.4 billion worth of savings so far as a result of the new coalition’s policy and legislative bonfire.

In today’s mini Budget the Finance Minister confirmed the savings made by repealing or stopping 15 programmes including 20 hours free early childcare for two-year-olds ($1.2b), removing depreciation for commercial buildings ($2.3b) and disestablishing the Climate Emergency Response Fund ($2b).

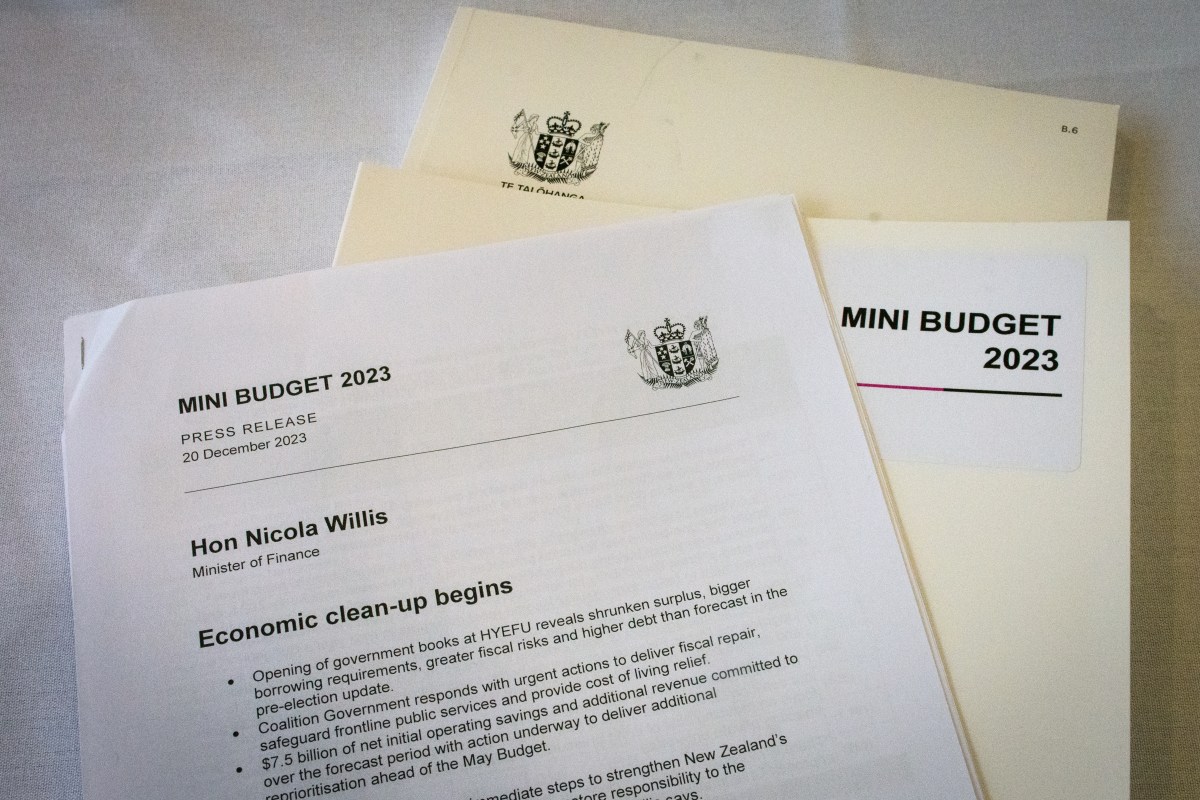

Nicola Willis said the savings could be considered a “down-payment on tax reduction”.

She said returning the Government’s books to surplus by 2027 remained a key priority but “had got a whole lot harder than it looked prior to the election” and Government spending had to get under control.

It comes as the Treasury’s half-year economic update today confirmed a weaker economy than when it reported pre-election and tough times ahead for households in the short term.

The update was completed prior to the coalition Government taking office and excludes some key data such as the September GDP figures.

Treasury said economic growth was forecast to average just 1.5 percent over the next two years, with higher interest rates dampening household and business spending.

Net migration had been higher than expected since the pre-election update and while it had helped to alleviate labour shortages and wage pressures for certain sectors, it was contributing to domestic inflation and higher house prices.

“Overall weak GDP growth coupled with high migration-led population growth, means that real GDP per capita is forecast to be lower across the forecast period than in the pre-election update and is forecast to decline until the end of 2024.”

With GDP growth expected to slow, the unemployment rate was estimated to rise and peak at 5.2 percent in early 2025.

The slowdown is also reflected in the Government’s books, which are expected to still return to surplus by 2026/2027; however that surplus at $0.1b is smaller than originally forecast due to lower tax take and higher finance costs.

Net debt will reduce largely as a result of declining growth in Government spending, reaching a peak of 23.3 percent of GDP in 2024/2025.

Longer term, the picture is that things will improve, interest rates are expected to return to within the targeted 1-3 percent band by late next year and remain at about the 2 percent mark from there, consumption will pick up from 2025 and house price growth will ease off.

Willis said it was a priority to return to surplus as soon as possible and had asked government agencies to find around $1.5b per annum in savings.

“This exercise brings together the $500 million per annum baseline savings exercise initiated – but not completed – by the outgoing government, along with our previously pledged commitments to reduce consultancy and departmental saving.”

The savings targets are set at 6.5 percent for most agencies but 7.5 percent where headcount has grown by more since 50 percent since 2017 levels.

“I have also asked ministers to undertake a ‘health-check’ on medium and high-risk capital projects in the investment pipeline for their agencies, to read, understand and respond to under-funding, cost blow-outs and delivery risks that may exist,” Willis said.

She said the previous government had left a number of “fiscal cliffs” where funding was only short-term for projects you might expect had long-term funding.

She today confirmed Treasury had identified 22 initiatives with time-limited funding that were worth at least $50m over the forecast period.

This includes funding for Covid-19 therapeutics and vaccines, film subsidies, temporary accommodation services, school lunches, Te Matatini and the apprenticeship boost scheme, all up worth $7.2b.

She said these would be gone through on a “case-by-case basis” as part of the Budget process

“We are going through each of those time-limited projects … some of them must be met, like Covid-19 vaccines … some of them are essential.”

She said she had already promised National Minister Tama Potaka that Te Matatini would continue to be funded.

“I won’t break that promise.”

Opposition responds

Labour finance spokesperson Grant Robertson said the mini Budget left New Zealanders without any certainty or a coherent economic plan.

“New Zealanders were told several things about the mini Budget. The first of those is that they would have certainty about how tax cuts would be paid for – that is not here. We were also told that we would know the details of the cuts to public services that were going to be used to fund tax cuts – that is not in here either.

He said the state of the books should not have been a surprise to anyone and reflected resilience “in the face of significant global economic shocks over recent years”.

“The differences here between what we saw in the pre-election fiscal update, in terms of those key economic indicators, is actually quite small, relatively speaking to the overall economy.

“New Zealanders have done it tough over the last few years, including with the cost-of-living pressures that they’ve been facing. But what these books show is that the previous government stepped up to help them and keep the balance about right.

“I’m proud of what we did as a government. We navigated through some very choppy seas, we keep New Zealanders in work, we’ve kept our level of public debt low relative to the rest of the world and we’ve seen the economy grow by about 7 percent since Covid began – I don’t apologise.”

Savings achieved by using the climate response fund for tax cuts, is this the money from ETS?

I have seen public service budgeting cuts before where in office management is retained at the expense of front line staff working out of Ministry offices.These frontline staff who work in schools . Preschools and peoples homes such as psychologists, therapists and social workers have been struggling for years with both high caseloads and the workload attached . Successive governments have never addressed this as the low lying fruit are the easiest to pick. Meanwhile middle and upper management continues to grow within the Public Service Sector.